How to Apply?

Applying for the Airtel Axis Bank credit card is easy! Just follow these simple steps:

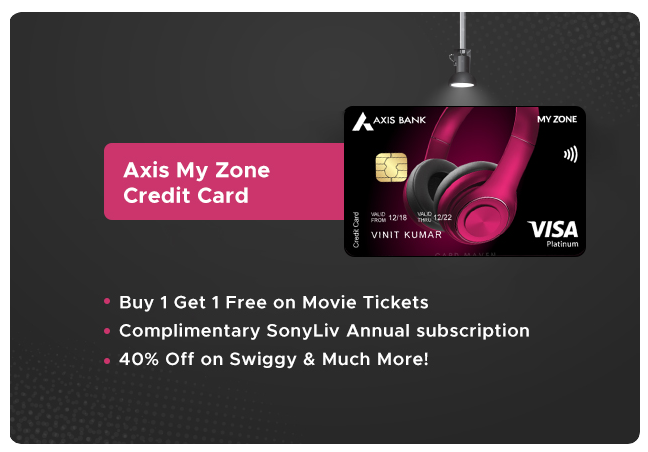

- Click this link: Apply for the Axis My Zone Credit Card

- Fill out the application: Provide your details and submit the form online.

- Verification: Once your application is received, the bank will verify your details.

- Approval: Upon approval, your new Airtel Axis Bank credit card will be sent to your registered address.

OTHER FEATURES OF THE CARD

Upto Rs 1000 Off on AJIO on minimum spends of Rs 2999 on select styles

4 Complimentary Lounge access on select domestic airports (1 per quarter)

4 EDGE REWARDS points per Rs 200 spent (Not Applicable on fuel, movie, Insurance, Wallet, Rent, Utilities, Education, Government Institutions and EMI transactions)

Dining delights offering Upto 15% Off at partner restaurants in India (Max Discount Rs 500)

1% Fuel Surcharge waiver at all petrol pumps across the country for spends between Rs 400 to Rs 4000

FEES AND LIST OF ALL CHARGES

Joining Fees: Rs 500

Annual Fees: Rs 500

DOCUMENTS NEEDED

PAN Card/Form 60

Colour photograph

Address proof

ID Proof

Income proof

ELIGIBILITY CRITERIA

Employment status: Salaried or Self-Employed

Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

Required Age: 21-65 years

WHY PROMOTE AXIS

Axis is the Third largest private sector bank in India offering entire spectrum of financial services for personal & corporate banking

Why Trust Axis Bank?

Axis Bank is one of India’s leading private sector banks, known for its customer-centric approach and innovative financial products. With a strong emphasis on security and reliability, your financial transactions are always safe with Axis Bank.

Conclusion

Don’t miss out on the opportunity to experience a world of rewards and convenience with the Airtel Axis Bank credit card. Apply now and start enjoying the benefits today!